What is an Independent Financial Adviser, or IFA?

An Independent Financial Adviser (IFA) can increase your wealth by applying planning and analytical skills to:

- Help you to identify your goals, then build a plan to achieve those goals

- Offer savings and investment products from the ‘whole of the market’ with no ties or bias

- Offer a wide range of products and services available in the UK.

- Use our experience and leading research software to compare the multitude of products available

- Use sophisticated tools to forecast your future wealth to help you stay on track in achieving your goals.

We are answerable only to you, our client, and to our regulator – the Financial Conduct Authority.

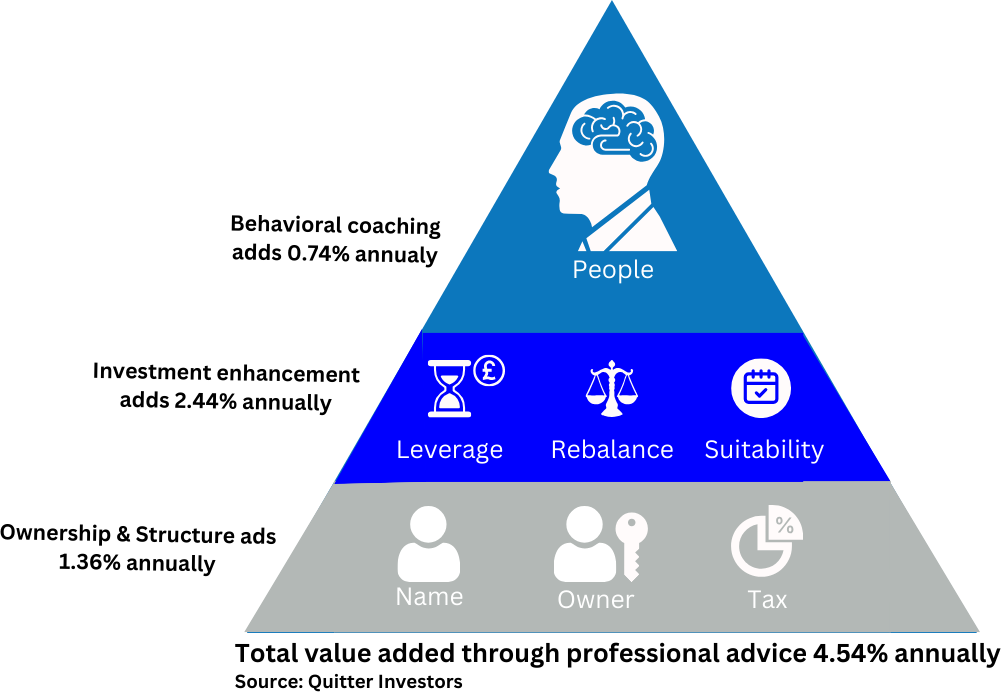

The value of independent financial advice

Did you know that independent financial advice can increase your wealth? Research proves that clients who have received financial advice are better off than those that haven’t:

- Receiving financial advice resulted in approximately £27,664 in additional pension wealth

- the overall value of receiving financial advice is approximately £41,099 additional financial and pension assets.

- Those who took advice have accumulated 20% more assets than those who have not taken advice.

Source: The value of financial advice A Research Report from ILC-UK. Assessed over the period 2001-2007.

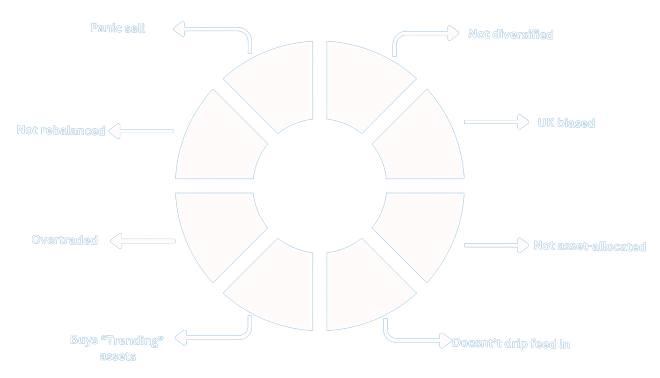

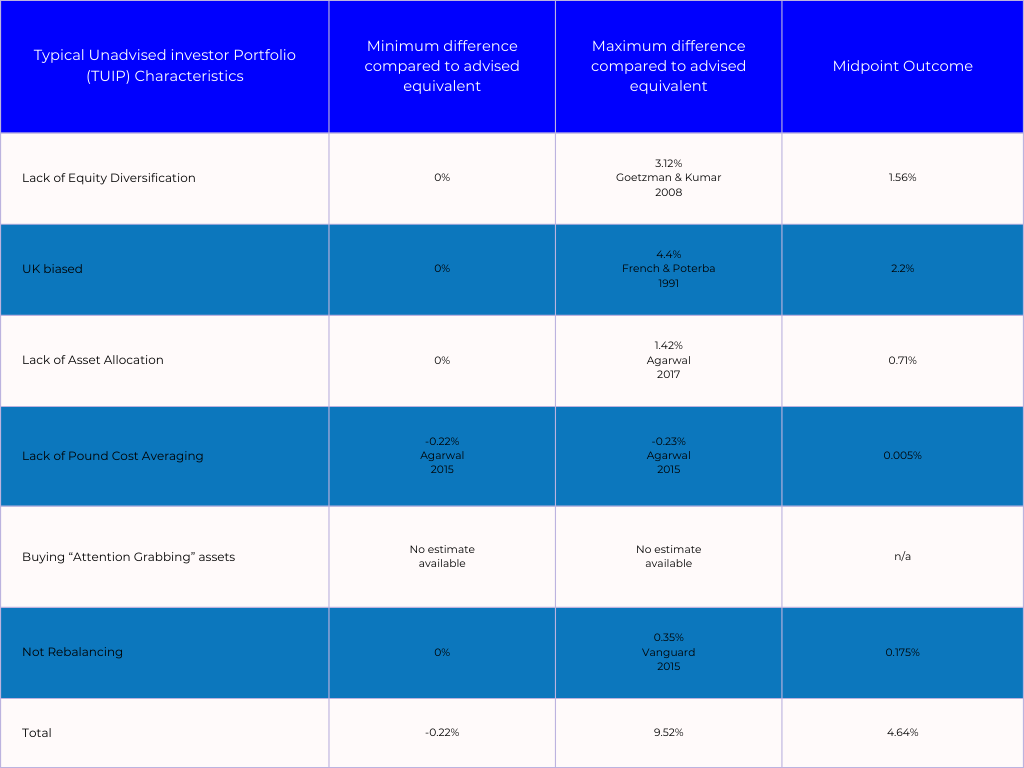

The typical self-advised client

Access to low-cost unadvised platforms is a means of keeping investment charges really low. However, investors that prefer to self-manage have been found to make a significant number of common mistakes that are rarely seen amongst advised clients.

These mistakes range from failing to diversify (such as everything in share funds) and not understanding the risks and potential rewards of investing overseas. We have recently seen many clients reliant on former “star” fund managers and lose their savings. Incidentally not one of our advised clients was invested with “that” fund manager. Investors alse tend to put too much reliance of “thematic” investing, such as technology, and fail to learn lessons from past corrections like the Dot-com bubble of the late 1990’s.

Are Independent Financial Advisers expensive?

These days typical hourly rates for IFAs are comparable to solicitors and accountants, reflecting the qualifications and expertise required. We like to think that we provide a value for money service, as seen in the table above. Financial planning requires a great deal of expertise, balancing complex legal and tax issues with forecasting, using a range of financial products.

Our charges reflect that our service is personalised to your needs. We take time to get to know you and your family, your circumstances, and financial goals.

We maintain strict standards of advice and adhere to the requirements of the FCA. Consequently, we bear the responsibility if things go wrong. Our advice is covered by the Financial Services Compensation Scheme.

We are highly qualified and skilled professionals, and hold specialised qualifications. We maintain regular Continuous Professional Development (CPD). Our charges reflect the time needed to maintain the skills of the advisers and support team.

Above all, we are transparent and always declare our fees before we advise you.

If you have any questions, or would like to know how we can help you, feel free to call us on 01202 622223 or send us a message using our online enquiry form.